Thanks to Art Criticism Became a Widely Read and Appreciated From of Journalism Winkleman

Art appreciation in the metaverse

What on the physical earth do art collectors see in a CryptoPunk? Add together to quick profits the bragging-rights of a Rolex and read on to rail the 'techtonic' shift

CryptoPunks. Screenshot, Lava Labs, 2021.

by JILL SPALDING

On 23 January 2021, live and in existent time, a pipe-smoking CryptoPunk, one of an edition of ix non-fungible token (NFT) algorithmic Aliens sold to the collective FlamingoDAO for 605 ethereum (ETH), the equivalent of well-nigh $850,000 or £609,280. Two days later on, a 2nd one sold for $2 one thousand thousand. Collectors vying to possess their top-selling companions – Zombies, Beanies and Apes – justified the transaction equally a solid investment, since each of these pixellated images is unique and posted for all time on the ethereum blockchain; only 10,000 such creatures will ever exist, and their provenance, proof of buying and attributes ("cap", "mohawk", "tiara") are cryptographically recorded and readily monetised. The artsphere's myriad blockchains are flooded with clever contenders, but Punks' primacy as the offset NFT images stored and traded on an unassailable blockchain places them and their owners in the pantheon.

CryptoPunk 7804, sold for ETH4200 ($vii.5 million), 10 March 2021.

Pushback against such exalted status begs the question, how did collecting get here? For me, the mean solar day dawned when I learned that the seller of said Aliens was a colleague, that he had caused them two years earlier for $55, and that his "wallet" holds 305 more than of these digital creatures. "A great purchase," tweeted fellow collector @gmoneyNFT, assigning that seemingly irrational acquisition to the same conspicuous consumption syndrome equally humans manifest in the concrete world. For the larger question of how did fine art become hither, best begin at the starting time.

By the mid-1960s, predating icons and cursors, visionary artists at the Slade School of Art in the United kingdom and Bell Labs in the US were producing computer-generated imagery at the level of Leon Harmon and Ken Knowlton's Nude (1967). The fine art world took scant note until decades subsequently, when artists such every bit James Faure Walker included digital art in their paintings, and Harold Cohen premiered Aaron, a robotic paint software plan used to describe on large sheets of newspaper. More intriguing, though, for artists than for galleries, digitally rendered images remained curiosities until improved skills created the masterful videos that opened collecting to the digiverse.

Evolution but not quantum. Trace the techtonic shift to 1983. I was researching an article for UK Vogue in Los Angeles titled The Terminal of the Ruby-red-Hot Smokers when its gonzo protagonist, Hunter Thompson, introduced me to Timothy Leary. Leary invited me and my 11-year-old son to dine with him, his wife Barbara, and their young son, Zack, in order to prove us his latest obsession. We were led to a small darkened studio of sorts, where a very young Jaron Zepel Lanier (at present at Microsoft Inquiry) was manipulating gloves wired to a greenish screen to create a seemingly random sequence of images – clearly super-cool, though we had no thought that what nosotros were viewing was the dawn of the metaverse. Lanier's genius achievement had averted today's clumsy Oculus Rift headset to insert his humanity directly into the images. The technology, however, beingness prohibitively difficult and expensive, was alee of its time, leaving video to plant the bankable medium until its creative potential reached its limits. Prepare to accept over, the revolutionary blockchain database opened a generation raised on pixels to the concept of fine art that can exist for ever accessed, collected, viewed, displayed, stored and tokenised in NFTs.

Early efforts were tentative. In 2014, the French creative person Youl created an NFT one-off, The Concluding (Bitcoin) Supper, and sold it on eBay for a so unimaginable $three,000. A host of unattributed silliness followed – cartoons, dervishes, even tweets – virtually of them freely downloaded until 2017, when the infamous CryptoKitties were posted for auction and almost crashed the ethereum network, triggering a fever for crypto-collectables so widely transacted that tracking them has become in itself an artform of sorts. Traditional artists climbed aboard with fungible hybrids. Andrés Reisinger took a crash course in industrial design and created biomorphic furniture that could be "collected" on a digital platform and either placed in a 3D metaverse such every bit Minecraft, or fashioned into physical objects. The starting time 10 sold in under 10 minutes, on the Winklevoss twins' online market Dandy Gateway, for an impressive $450,000: the most expensive was a unique piece to be co-created with the buyer. The year 2020 saw a rash of lucrative offerings designed past such colourful names-to-know equally FEWOCiOUS, Giant Swan, DJ deadmau5, M&M, and Mad Canis familiaris Jones. Avid collectors moved to more sophisticated algorithms such every bit Dmitri Cherniak's Ringers (generated in Javascript in the browser: full minted, ane,000), each output derived from a unique transaction hash and featuring a different variation (sizing, layout, orientation) of the space number of ways to "wrap a string around a set of pegs".

Dmitri Cherniak, Ringers. Twitter screenshot, 19 March 2021.

Where, though, in all these postings was the art? There and not at that place, viewable and intangible, at one time an image that can be projected on to a wall and the metaphor for an paradigm that is, essentially, lawmaking. Considering blockchain artworks are impossible to damage, steal or copy, the sudden need to own one handed collectors another collectible article and gave the world, very arguably, a new art form. While CryptoPunks started it and shall ever be the gold coin of the realm, even nameless artists establish a home on the blockchain. Already, more than than lxx,000 of their pixellated whatnots have sold for well over $100m, confirming NFTs as the hereafter not but of digital art but all digital property – in Flamingo-speak, "the tip of a very large spear" – and, equally I propose, a new image.

Similar it or not, just every bit NFT JPEGs take upended the historical canon, so have they challenged the concrete evidence space and scrambled – indeed, reversed – the roles of artist and patron. Firstly, by eliminating all who stand between creation and sale – dealers, agents, art advisers and fine art critics. For the digital artist, with no 1 taking a cutting, and with no demand for a physical studio, work transacted on the blockchain is pure gravy, generally garnering 100% of the initial sale and a 10% royalty every fourth dimension information technology's resold. In February, on brusk find and over 48 hours, the music and video artist Claire Boucher, AKA Grimes, earned more $6m for 10 pieces; 2 of them, Mars and World (digital videos in editions of 300), sold for $seven,500 each, and one, Decease of the Quondam, built in a bidding state of war to virtually $400,000. On 1 March, the first iteration of Matt Furie'southward cartoon frog, Homer Pepe, sold for $312,000. On iii March, electronic dance music star Justin Blau realized $xi.7m from 33 NFTs giving access to new music, a custom song, new versions of quondam songs and a real-world vinyl disc. On vii March, Dream Catcher, an 8-piece collaboration between Hamburg graphic creative person Antoni Tudisco and trip the light fantastic/music producer Steve Aoki sold for $four.25m, its star attraction – "hammer" price $888,888 – a ten-2nd prune of a moving hirsute head titled Hairy. Trading briskly on multiple platforms is the crypto-artist Pak, creator of the AI-powered prototype-sharing site Archillect (his identity and then obscured that he is rumoured to be an AI). Even lower-profile artists such every bit Mario Klingemann, Robbie Barrat, Trevor Jones and José Delbo have been selling in the six figures.

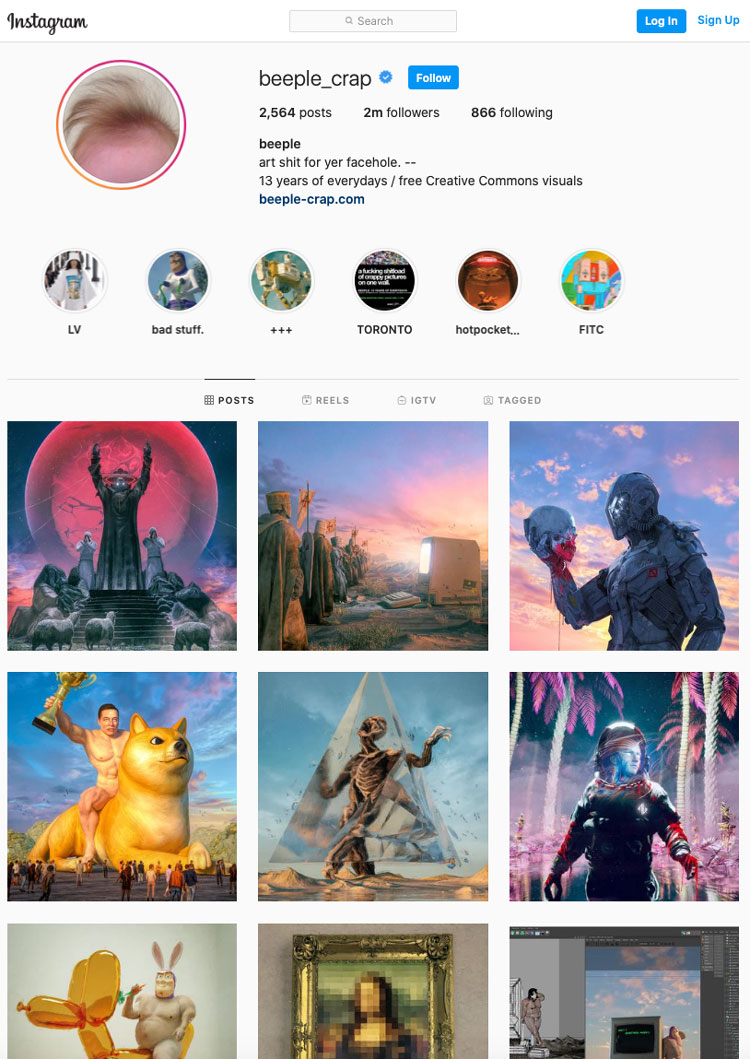

Madness? Non for the "woke" generation. Like the boomers with baseball cards, they are comfortable investing in any meme living and trading on a blockchain – sports clips, flying French fries – any image that amuses. Crypto art, they will tell you lot, is fun and fabulous. Every bit Aoki said in a press release: "NFT's gave me an opportunity to finally merge art, collectible culture and music in a way I've never been able to realise earlier." And no need to bet the farm. A $100 investment bought into a 40-fellow member fund with four,800 ETH in pooled capital letter and an extensive collection that includes "landplots" in various metaverses. A mere $xv.l delivered commonage ownership of B20, a piece of work by the currently hotissimo crypto-creative person Mike Winkelmann, moniker Beeple, which fast doubled its value.

The medium being the message, ether-art should non come equally a shock. Fifty-fifty for boomers, TV viewing morphed so chop-chop to streaming that when the New York Times dropped its TV guide it lost few subscribers. With high-profile collectors of traditional fine art such as Elon Musk and Mark Cuban signing on, and with Gen Alpha communicating near exclusively on crypto-channels, closer than predicted is the solar day when we all will exist experiencing art in a virtual earth.

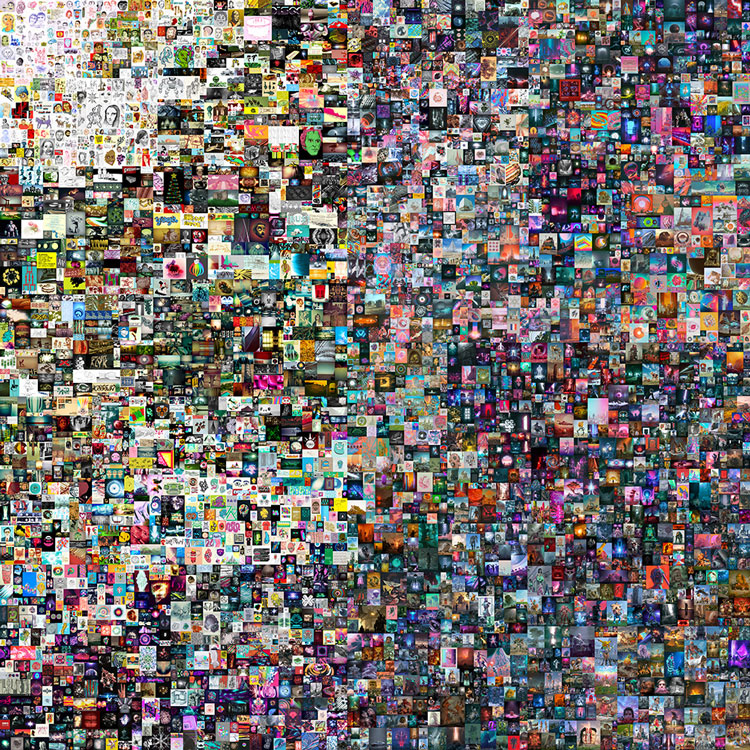

Mike Winkelmann, aka Beeple, Everydays: The First 5000 Days, Not-fungible token (jpg), 21,069 x 21,069 pixels (319,168,313 bytes), minted on 16 February 2021.

Most telling is Beeple's coronation at Christie's on 11 March, when Everydays: The First 5000 Days – a reckoner collage of digital drawings created singly every day for 13-plus years, minted exclusively for the auction firm, and accounted by the pseudonymous buyer, Metapurse founder Metakovan (Vignesh Sundaresan), "the most epic cultural project and event to happen in the metaverse to date" – topped the December 2000 $3.5m sale of Winkelmann'south bundled works and crushed the $6m auction of his 10-2nd clip portraying people walking past a dead Donald Trump, to shut at $69.4m, the 3rd-highest cost paid for a living artwork by a living artist. Although the conceit is not new (think On Kawara's one-a-twenty-four hours paintings) and the piece of work is a "hash" of off-chain images (unsatisfying for purists in that the collage itself is not on a blockchain), the monetary render crowning the newly minted masterpiece has dramatically widened the opportunity for collecting. So has the gravitas of the first-ever auction to be given entirely to crypto art and to accept crypto payment – the papal-blessing equivalent of Goldman Sachs trading bitcoin – set a new bar of sorts. Even Winkelmann was stunned: interviewed mid-auction by Jeffrey Chocolate-brown for United states broadcaster PBS, the self-styled designer described his "non-for-everybody" pop civilisation postings every bit "weird stuff", and the term creative person every bit "super-pretentious – I can't even say information technology!" His bewilderment was humanising, and, for me, hearteningly gonzo. But he may be the terminal of the first.

@beeple_crap, Instagram, screenshot, 19 March 2021.

Already Damien Hirst, e'er ready to jump on the new thing, has announced that he will accept cryptocurrency for his new run of prints: "I honey the crypto world." How long can it exist earlier he, or David Hockney or Jeff Koons go crypto? And how, so, will NFT work by old-schoolhouse artists exist valued? Call back back to the installation Agnes Gund funded at the MoMA consisting of six interactive flowcharts by Peter Halley that were physically displayed on walls specially built for them. Viewers segued to a massive reckoner (this being 1997) programmed to show all the images plus a digital pen and palate, and were invited to create an original work filled in with their colours of choice; to download it, co-sign it and,with Halley'south name pre-printed lesser left, co-sign on the bottom correct, and take the work dwelling house. Calculating the limited number created (given computer breakdowns and the installation'due south short duration) and the considerable number destroyed (I saw one in a bin on exiting), I estimate that my work might at present be worth $200. Say that the next person to fill in, download and co-sign one had been Jasper Johns, its electric current value would eclipse all. In the metaverse, though, maybe not.

Ascribing monetary value to an image is not, of course, to anoint information technology equally art. Asking what might qualify it as such begs the fourth dimension-immemorial question of what constitutes art? Marcel Duchamp famously said that art is any he hangs in a museum. By that measure, note ZKM (Center for Fine art and Media, Karlsruhe), the bricks-and-mortar museum known as the "electronic Bauhaus", whose mission is to take the spatial arts of painting, sculpture and photography into the digital historic period. Last year, the art market SuperRare launched a crypto art museum on Decentraland, and the outset-ever NFT art exhibition is opening soon at the UCCA Heart for Gimmicky Fine art in Beijing. Unless the Whitney muscles in with a Crypto Biennial, such venues are where collectors will be scouting new artists.

Not all are on board. Many the sceptic who attributes the wild action to frenzy, that bane of the tulip moment that may fold blockchain transaction into our long history of bubbles. Before all, they caution, crypto investment depends on a universally accepted gold standard-equivalent currency: in the crypto wintertime of 2018, digital assets took a spectacular fall, providing another tale of emperors with no clothes. Simply with the zeitgeist go blockchain, note the cryptophiles, cryptocurrency soon recovered, rescued from the nebula of mafia transactions by such knights in shining bitcoin every bit Jamie Dimon and David Solomon.

They type that crypto art is on certain ground because coded images, the visual language of the metaverse, are valued according to ancient rules of collectability; authentic, rare, unique and, above all, "first". If aesthetics have been sidelined, has not the ideal of beauty been dying the slow death of beautiful-to-y'all-not-to-me since diversity and identity started eating away at the classical canon? And if a heavily retouched – indeed disputed – Da Vinci can fetch $450m, is it so wildly out of line that an Alien sold for $7m?

Heady stuff, so what gives interruption? Well-nigh immediately, a lack of clarity – the tangle caused by craze: pure or impure; people or avatars; galleries or sites, and bidders who present as pixels like the prominent DeFi (decentralized finance) personality @0x_b1. Troubling that, in the supposedly freewheeling online marketplace, the digital collectibles site Rarible censored pinnacle-selling conceptual/appropriation artist Rulton Fyder on grounds not disclosed. Disturbing, too, are the criteria marking crypto art as collectible. If aesthetics are irrelevant and if no-name creators who sell well are held artists, then value derives largely from community-conferred condition. Add in the hoarding syndrome recalling the Nahmad brothers' stash of Picassos parked for lucrative resale; the unnerving whiff of big business – call it crypto-corporate – attached to SPACs (special purpose conquering companies formed to take blockchain entities public); and exclusive crypto-funds such as Metapurse, which bundle works, then sell, loan or store them until their value skyrockets. Heavily invested in Dapper Labs' blockchain Menstruation, for example, alongside National Basketball Association players such as Spencer Dinwiddie, JaVale McGee, Aaron Gordon and Andre Iguodala, are the crypto firms Coinbase Ventures and BlockTower Capital.

Why, so, a new paradigm? What places crypto fine art light years beyond today's diversity and identity art? Although it'due south unlikely that a tokenised Kehinde Wiley or Kara Walker will be inhabiting a digital museum any time soon, and no one – fifty-fifty should canvas look all of a sudden dated – will exist throwing out the Warhols with the bathwater, the concept of blockchain-produced fine art is gripping and addictive. Yep, the techniques are replicable and the talent surpassable, but the metaverse has opened new worlds. Fifty-fifty neophyte collectors can avoid the tumble down the fastest-way-to-lose-your-shirt rabbit hole past scouting the first, the rare, and the visually stimulating, safely cushioned in pride of ownership and primed for the future. Groundbreaking, as well, a system that guarantees authenticity (it's been estimated that 20% of the art in U.k. museums is fake), obviates the hassles of shipping, insurance, storage and legal costs of moving physical art, and gives collectors wide Instagram admission to galleries and power brokers heretofore invested in running the art world similar a club.

Still, equally with life itself, where in that location's a yin at that place's a yang. How long volition the sophisticated collector exist satisfied with owning nothing more an entry on record? Won't we pine for communal viewing in physical spaces? There is too the seriously limiting factor of network capacity – the for-now inescapable environmental bear upon of material created and stored on a blockchain. The free energy exacted to transact 303 editions of Grime's Earth was estimated to equate to the electricity the boilerplate European union denizen uses in 33 years, and produced 70 tonnes of CO2 emissions. That, counter the tech-savvy, is for now. Blockchain engineers are scouting alternate sources, and the art-centric envision fast-evolving new technologies that will decentralise and reshape the unabridged art market apparatus. Bricks and mortar museums, galleries and art fairs are already designing compelling new formats for display in soon-to-be-realised concrete worlds of interactive, immersive engagement.

My caveats differ. I have no quarrel with a creative expression that tin exist endlessly reproduced, easily downloaded and handily monetised on a blockchain. I applaud returns guaranteed in perpetuum that enable artists to accept bureau, and the programmable scarcity that gives their work value. And I recall information technology efficient – even healthy – that globally continued digital marketplaces combine the functions of gallery, museum, sale house and social platform. Laudable, too, is an ecosystem that brings transaction out of the secretive mega-gallery penumbra into the light of a community platform. I wonder, withal, nearly the selection process; submissions to SuperRare, for example, are critiqued on its editorial and vetted by commission – well, past whom? For the neophyte, sans art historian or curator, what replaces the trained heart? And how can the crypto-collector who buys on an Instagram-way social feed not be influenced past its influencers – crypto enthusiasts more than interested in pop than in quality?

More urgently, what does crypto fine art bring to the table? For the collector, status, of course, plus provenance, security, transportability and proof of ownership. For the artist, elasticity and no middleman. And all note the ease of display – peachy that work can be flashed on a wall, screen, mobile phone, or the palm of your hand. Simply in the virtual world, display is non really the point. Rather, information technology'south the loftier delivered by lightning turnover and rocketing prices that has taken crypto art mainstream. As that dedicated owner of Crypto-Punks said of his "purely as speculation" investment in a fractionalised piece of the bundle of 20 Beeple works that, on 9 March, reached $90m, crypto art speaks to "gambling for sure".

My larger concern is with the ever-expanding definition of art. Reflecting on art is my profession, but takes upwardly less of my bandwidth than feeling information technology. At the moment of encounter, I don't deeply care about provenance, budgetary value, historical importance, or place in the canon. A work that I interact with must accomplish out to me: if I don't experience it, I move on. "The globe moved," Hemingway's sign of passion, is my key to art. Like love, fine art must course through my veins. While I can stretch the membrane to embrace performance art, and have become fond (the word is soft but accurate) of graffiti, I don't respond viscerally to virtual world silliness such equally pixellated wizards, the galloping Nyan Cat, and the zillion other VR memes developed overnight to shape the social experience.

And thereby the caveat. Does a geolocated pixel Kaws' Companion elicit the emotion of Rembrandt's The Jewish Bride that brought Van Gogh to tears? As with holography, the art medium that flamed in the late 1970s (Louise Bourgeois, Larry Bell, Ed Ruscha) only before long sputtered, something primal has been lost in all this fungibility, and I cannot but think that it's the art. While I welcome the infinite visual possibilities opened up by the metaverse, seeing quality cede to scarcity, and art appreciation move from wall to wallet, I find myself pleading with the Art God to requite me back a painted surface which, at a castor-length away, I can stand up where the painter stood; a sculpture that I can run my mitt along where the sculptor did. Even a photograph, then removed when outset proposed as fine art, invites the center to focus in on it similar a lens.

These concerns are generational, of course. The young are programmed to vibrate to algorithms: coded images speak to them; shared ownership comforts them. Whereas for the former guard, owning great art is emotional and trading it is transactional, for the crypto art collector the distinction is arcane – the 2 co-exist seamlessly. The analogy of progressive eyeglasses is helpful: the fine art exists on the wall and in the wallet simultaneously. Had Rothko refused a commission because his paintings were to hang in a restaurant? Meaningless. The blockchain is not a venue, it's ether – and that is the thrill. Information technology may seem that this natively digital platform has upended art, but it is non art that is morphing, it is humans. Along with the expansion of art'due south definition in the metaverse, how we experience art is evolving, ceding art appreciation to art's appreciation. Now, merely a work'due south hype and tagging motivate purchase. Now possession alone and ownership's endless possibilities of gamesmanship confer status. There is no denying the psychic loftier of flexing a rare collectible, placing a bid on a social feed, and interacting with a work instead of "just looking" at information technology. My colleague explained it this way: "Information technology'south the rush of the borderland – beingness starting time to encounter and grasp the import of a new artefact – in this instance, one that constitutes art by having been crafted past an artist. Add to its collectability that it'due south unique, its buying registered as mine on the cake concatenation. Information technology'south liquid – my entire collection hangs in my iPhone. It's hassle-costless – no concerns near protective glass to foreclose fading. And it's fun – I can flash individual images on a wall-screen, show them around, trade them, build on them, bargain them." To add together to his drove, he trawls the net to discover a slacker who has underpriced a Zombie or to see what'due south on offering in the eponymous plot created by "whale" game designer Pranksy in the ethereum-powered virtual-earth Cryptovoxel. "And, should I decide to sell one, there's no middleman to deal with, no dealer or sale house."

Tellingly, he has already pounced on the new matter – Autoglyphs! Thrillingly "on-chain" (chain-generative), this quantum generation of images, although created by the artist, remains random, not fully existing until realised on a blockchain. The code itself is the actual work, enabling virtual images that, although tiny, since coding them larger on a blockchain is economically unfeasible, are too (think a crypto-Sol Lewitt) actual and instructional – and thereby, very arguably, constitute a new art grade, and then prized that owning just a fraction of one is enhancing.

Thus accept crypto creators stormed the barricades, and thus is crypto art a certifiably new paradigm. As art history teaches, later on each revolution – perspective, impressionism, cubism, abstract expressionism – the toothpaste, as went the proverb, could non be put back in the tube. So, whether you sign on to cryptomania as collecting, investing, or gambling, as with every new paradigm, attending must exist paid.

Source: https://www.studiointernational.com/index.php/art-appreciation-in-the-metaverse-crypto-art-non-fungible-tokens-mike-winkelmann-beeple